Digital credit

Samsung Pay and Apple Pay are services that allow users to save their credit cards into their phones and use the phone to pay at the cashier. There's no need to bring the credit card out.

@Samsung

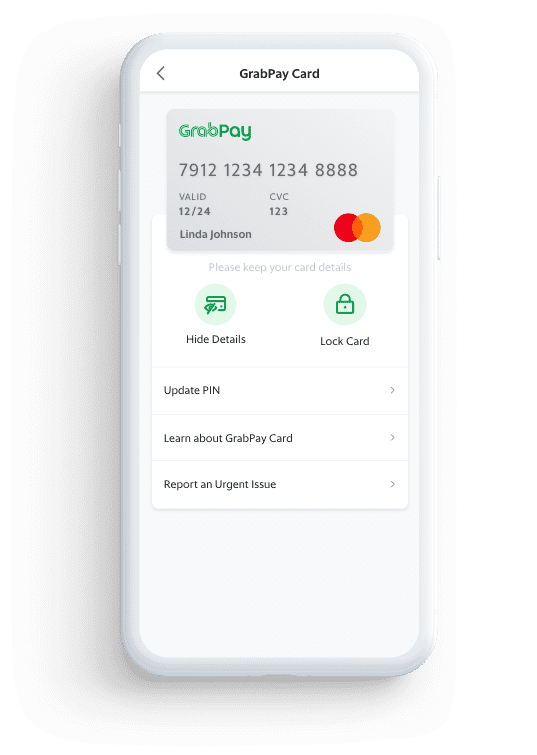

GrabPay introduced it's own numberless card too. That's because people don't need to use the 16-digits at the cashier.

Grab Singapore

You would still need the number for online shopping. The card number is available on the Grab App.

Grab Singapore

Credit Card Technology

There's really no money in the card itself. The money is in the bank. And since it's a credit card (not a debit card), the bank pays for your purchase first. When you pay with plastic, a record is sent from the merchant to the bank about how much you spent. All the records of your spending is kept in your account so that they can bill you at the end of the month.

There's actually four ways to pay with your credit card.

- Swipe

Old school. The cashier would swipe your card, print a receipt, and ask you to sign it. The swipe uses the black magnetic strip (or magstripe) at the back of the card. It's a layer of iron oxide that changes the magnetic field in a card reader. The unique combination of magstripe is your credit card information.

- Contactless

Most convenient and for small transactions. You just need to tap or wave (as in payWave) you card on the cashier's card reader. It uses RFID or NFC, both which are wireless technology that ride on radiowaves. No PIN is required for this.

- Chip and PIN

Better than swipe. The cashier would plug your card into the reader and ask you to key in the 6-digit pin number. Similar to withdrawing money at the ATM.

- Credit card number

You'd use this online or on paper forms (like signing up for a gym membership). Online payments usually requires the other 3-digit CVV at the back of the card. Even though paper forms don't require it, anyone who had a copy of your paper form and saw the 3-digit CVV could use your card. The GrabPay numberless card removes this problem.

Cards in phones

If you haven't already guessed it, Samsung Pay and Apply Pay uses the contactless technology. They leverage on Magnetic Secure Transmission and NFC to mimic cards on the card reader. All you'd have to do is save the card information in the phone. GrabPay isn't in the picture because it's an app, not a phone. If you had your GrabPay in a Huawei for example, it doesn't work because Huawei hasn't created that contactless feature yet.

Now, a credit card is simply a short-term loan from the bank. What's stopping banks from offering digital credit cards via the smartphone instead of a physical one? Would it even be called a card anymore? Some banks also already allow ATM withdrawal from the mobile app - so there's actually no need for debit cards.

Cards are just a representation of your identity to a machine. So if a phone could do it, why would we need plastic anymore? One less item in the pocket.

Back